Introduction

In a world where financial stability often feels out of reach, https// thepeoplesbudget.org stands as a beacon of hope. Designed to empower consumers, financial enthusiasts, and policy advocates alike, this platform is changing the way people think about budgeting and financial management. This blog post explores the unique features and benefits of https// thepeoplesbudget.org, shedding light on how it can help you take control of your finances. Whether you’re a seasoned financial expert or someone just looking to make ends meet, https// thepeoplesbudget.org offers invaluable resources tailored to your needs.

Why Financial Literacy Matters

Financial literacy is the foundation for making sound financial decisions. Understanding how to manage money, invest wisely, and save for the future can have profound impacts on one’s quality of life. https// thepeoplesbudget.org recognizes this and offers a range of tools and resources to help users at every stage of their financial journey. From basic budgeting tips to advanced financial strategies, the platform is designed to make financial literacy accessible to all.

The lack of financial literacy can lead to poor financial decisions, resulting in debt and financial stress. https// thepeoplesbudget.org aims to bridge this gap by providing easy-to-understand information and practical advice. By empowering users with knowledge, the platform helps them make informed decisions that benefit their financial well-being.

In today’s fast-paced world, financial literacy is more important than ever. With the right tools and resources, anyone can achieve financial stability and success. https// thepeoplesbudget.org is committed to helping individuals achieve their financial goals by offering comprehensive resources and support.

The Core Features of https// thepeoplesbudget.org

One of the standout features of https// thepeoplesbudget.org is its comprehensive budgeting tools. These tools are designed to help users track their income and expenses, set financial goals, and create a budget that works for them. The platform offers a range of customizable templates and calculators, making it easy for users to get started.Another key feature is the educational content available on the platform. From articles and videos to webinars and workshops, https// thepeoplesbudget.org offers a wealth of information on various financial topics. This content is designed to educate and inspire users, helping them make informed financial decisions.

In addition to budgeting tools and educational content, https:/ /thepeoplesbudget.org also offers community support. Users can join forums and discussion groups to connect with others who share their financial goals. This sense of community can be incredibly motivating and provides valuable support and encouragement.

How to Get Started with https://thepeoplesbudget.org

Getting started with https// thepeoplesbudget.org is easy. Simply visit the website and sign up for a free account. Once you’ve created your account, you can start exploring the various tools and resources available on the platform. Whether you’re looking to create a budget, learn about investing, or connect with others, https// thepeoplesbudget.org has something for everyone.The first step is to set up your profile and input your financial information. This will allow the platform to provide personalized recommendations and insights based on your unique financial situation. From there, you can start exploring the various tools and resources available on the platform.

If you’re not sure where to start, https// thepeoplesbudget.org offers a range of guides and tutorials to help you get the most out of the platform. These resources are designed to be informative and easy to understand, making it easy for users to get started on their financial journey.

The Importance of Setting Financial Goals

Setting financial goals is a crucial step in achieving financial stability and success. https// thepeoplesbudget.org emphasizes the importance of setting realistic and achievable goals. By setting clear financial goals, you can stay motivated and focused on your financial journey.

One of the tools offered by https// thepeoplesbudget.org is a goal-setting worksheet. This worksheet helps users identify their financial goals and create a plan to achieve them. Whether you’re saving for a vacation, paying off debt, or investing for the future, the goal-setting worksheet can help you stay on track.

In addition to the goal-setting worksheet, https// thepeoplesbudget.org also offers tips and strategies for achieving your financial goals. From creating a budget to cutting expenses, these tips can help you make progress towards your goals and achieve financial success.

The Role of Budgeting in Financial Success

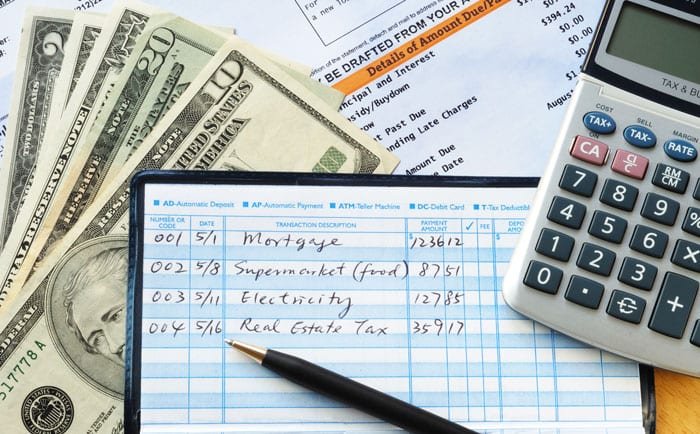

Budgeting is one of the most important aspects of financial management. A well-planned budget can help you track your income and expenses, save for future goals, and avoid debt. https// thepeoplesbudget.org offers a range of budgeting tools and resources to help users create and maintain a budget.

One of the budgeting tools offered by https// thepeoplesbudget.org is a customizable budget template. This template allows users to input their income and expenses, and automatically calculates their budget. This makes it easy to see where your money is going and identify areas where you can cut back.

In addition to the budget template, https// thepeoplesbudget.org also offers tips and strategies for effective budgeting. These tips can help you create a budget that works for you and stay on track with your financial goals. From tracking your spending to setting up automatic savings, these tips can help you achieve financial success.

Investing for the Future

Investing is a key component of financial planning. It allows you to grow your wealth over time and achieve your long-term financial goals. https// thepeoplesbudget.org offers a range of resources to help users learn about investing and make informed investment decisions.

One of the resources offered by https// thepeoplesbudget.org is a guide to investing. This guide covers the basics of investing, including different types of investments, risk tolerance, and investment strategies. It is designed to be informative and easy to understand, making it accessible to users of all levels of experience.

In addition to the investing guide, https// thepeoplesbudget.org also offers tips and strategies for successful investing. These tips can help you make informed investment decisions and achieve your financial goals. From diversifying your portfolio to understanding market trends, these tips can help you become a successful investor.

Managing Debt

Debt management is an important aspect of financial planning. https:// thepeoplesbudget.org offers a range of resources to help users manage their debt and achieve financial stability. From tips on paying off debt to strategies for avoiding debt, these resources can help you take control of your finances.

One of the tools offered by https:// thepeoplesbudget.org is a debt management calculator. This calculator helps users input their debt information and create a plan to pay it off. This makes it easy to see how much you owe and create a plan to pay it off over time.

In addition to the debt management calculator, https:// thepeoplesbudget.org also offers tips and strategies for managing debt. These tips can help you stay on track with your debt repayment plan and achieve financial stability. From creating a budget to cutting expenses, these tips can help you take control of your debt and achieve financial success.

Saving for Retirement

Saving for retirement is an important aspect of financial planning. https:// thepeoplesbudget.org offers a range of resources to help users save for retirement and achieve their long-term financial goals. From tips on saving for retirement to strategies for maximizing your retirement savings, these resources can help you achieve financial stability in retirement.

One of the resources offered by https:// thepeoplesbudget.org is a retirement savings calculator. This calculator helps users input their retirement savings information and create a plan to save for retirement. This makes it easy to see how much you need to save and create a plan to achieve your retirement goals.

In addition to the retirement savings calculator, https:// thepeoplesbudget.org also offers tips and strategies for saving for retirement. These tips can help you maximize your retirement savings and achieve your long-term financial goals. From creating a budget to investing for the future, these tips can help you achieve financial stability in retirement.

Building an Emergency Fund

Building an emergency fund is an important aspect of financial planning. An emergency fund can help you cover unexpected expenses and avoid debt. https:// thepeoplesbudget.org offers a range of resources to help users build an emergency fund and achieve financial stability.

One of the tools offered by https:// thepeoplesbudget.org is an emergency fund calculator. This calculator helps users input their income and expenses and create a plan to save for an emergency fund. This makes it easy to see how much you need to save and create a plan to achieve your emergency fund goals.

In addition to the emergency fund calculator, https:// thepeoplesbudget.org also offers tips and strategies for building an emergency fund. These tips can help you stay on track with your savings plan and achieve financial stability. From creating a budget to cutting expenses, these tips can help you build an emergency fund and achieve financial success.

Financial Planning for Families

Financial planning for families is an important aspect of financial management. https:// thepeoplesbudget.org offers a range of resources to help families plan for their financial future. From tips on budgeting for families to strategies for saving for college, these resources can help families achieve financial stability.

One of the resources offered by https:// thepeoplesbudget.org is a family budget template. This template helps families input their income and expenses and create a budget that works for them. This makes it easy to see where your money is going and identify areas where you can cut back.

In addition to the family budget template, https:// thepeoplesbudget.org also offers tips and strategies for financial planning for families. These tips can help families create a budget, save for the future, and achieve their financial goals. From tracking your spending to setting up automatic savings, these tips can help families achieve financial stability.

The Benefits of Financial Education

Financial education is an important aspect of financial planning. https:// thepeoplesbudget.org offers a range of resources to help users learn about financial planning and make informed financial decisions. From articles and videos to webinars and workshops, these resources can help users achieve financial stability.

One of the resources offered by https:// thepeoplesbudget.org is a financial education library. This library contains a wealth of information on various financial topics, including budgeting, saving, investing, and debt management. This makes it easy for users to learn about financial planning and make informed financial decisions.

In addition to the financial education library, https:// thepeoplesbudget.org also offers tips and strategies for financial education. These tips can help users learn about financial planning and achieve their financial goals. From creating a budget to investing for the future, these tips can help users achieve financial stability.

The Importance of Community Support

Community support is an important aspect of financial planning. https:// thepeoplesbudget.org offers a range of resources to help users connect with others who share their financial goals. From forums and discussion groups to live Q&A sessions with financial experts, these resources can provide valuable support and encouragement.

One of the resources offered by https:// thepeoplesbudget.org is a community forum. This forum allows users to connect with others who share their financial goals and exchange tips and advice. This sense of community can be incredibly motivating and provides valuable support and encouragement.

In addition to the community forum, https:// thepeoplesbudget.org also offers live Q&A sessions with financial experts. These sessions allow users to ask questions and get personalized advice on their financial goals. This can be incredibly helpful for users who are looking for guidance and support on their financial journey.

Conclusion

In conclusion, https:// thepeoplesbudget.org offers a range of resources to help users achieve financial stability and success. From budgeting tools and educational content to community support and personalized advice, the platform is designed to empower users at every stage of their financial journey. Whether you’re a seasoned financial expert or someone just looking to make ends meet, https:// thepeoplesbudget.org has something for everyone.

By taking advantage of the resources offered by https:// thepeoplesbudget.org, you can take control of your finances and achieve your financial goals. From creating a budget and saving for the future to managing debt and investing for the future, these resources can help you achieve financial stability and success. Take the first step towards financial stability today by signing up for a free account on https:// thepeoplesbudget.org.